Sales Invoice or Bill is a commercial document issued by a seller to the buyer, indicating the products, quantities, and agreed prices for the product or services the seller has provided to the buyer.

An invoice indicates that the buyer must pay the seller, according to the payment terms. The buyer has a maximum amount of days to pay these goods and are sometimes offered a discount if paid before.

To create Invoice Voucher,

Gateway of Tally —–> Create —–> Voucher Type

Name: – Sales Invoice

Types of vouchers: Sales

Abbrv. Sale.

Method of voucher numbering: – Automatic

Use Advance Configuration: – No.

Use Common narration: – Yes

Printing: –

Print after saving voucher: – Yes

Use for POS invoicing: – No

Default print title: – TAX Invoice

Is Tax invoice: – Yes

Declaration: – Term and condition of your Business.

Do the following transaction: –

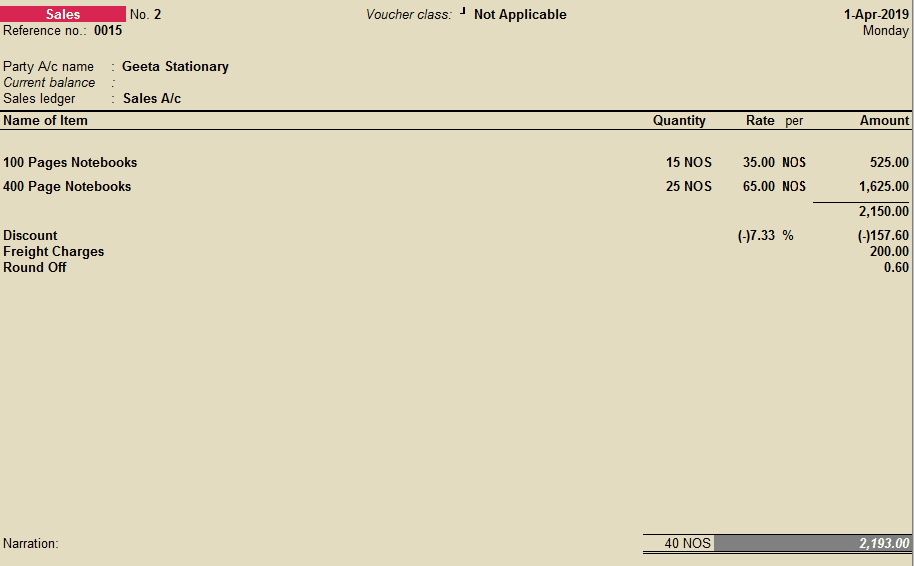

Sold 15 qty of 100-page notebooks each at 35 rupees and 25 qty of 400-page notebooks each at 65 rupees to Geeta Stationery, where 7.33% discount was given on total value of goods, with additional freight charges of 200 rupees. Do the entry with rounding off methods.

Ledger creation: –

- Geeta Stationery (Sundry debtors)

- Sales A/c (Sales Accounts)

- Freight Charges (Indirect Incomes)

- Discount (Indirect expenses)

- Round off (Indirect Income)

Gateways of Tally—> vouchers—-> Sales Voucher (F8) —-> Select Sales Invoice

Sales Invoice (F8): –

Assignments: –

- Sold 3 Motorola power one mobile each at 13,499 rupees to Novelty and co, where 4.53% discount was given on total value of goods, with additional freight charges of 150 rupees. Do the entry with rounding off methods.

- Sold 2 Dell Laptop each at 15000 rupees to Anupam Computech and Co, where 5.63% discount was given on total value of goods, with additional freight charges of 250 rupees. Do the entry with rounding off methods.