Export of goods in tally

Export of Goods in Tally Prime refers to recording and managing sales transactions where goods are sold to a foreign buyer (outside India). Under the GST law in India, exports are considered Zero-Rated Supplies, meaning they attract 0% GST but require proper documentation for compliance.

A Sales Export Entry in Tally Prime refers to recording a sales transaction for exported goods in compliance with GST (Goods and Services Tax) rules. This is applicable when a business sells goods or services to a foreign country.

In India, exports are considered zero-rated supplies, meaning they attract 0% GST but still require proper documentation and filing.

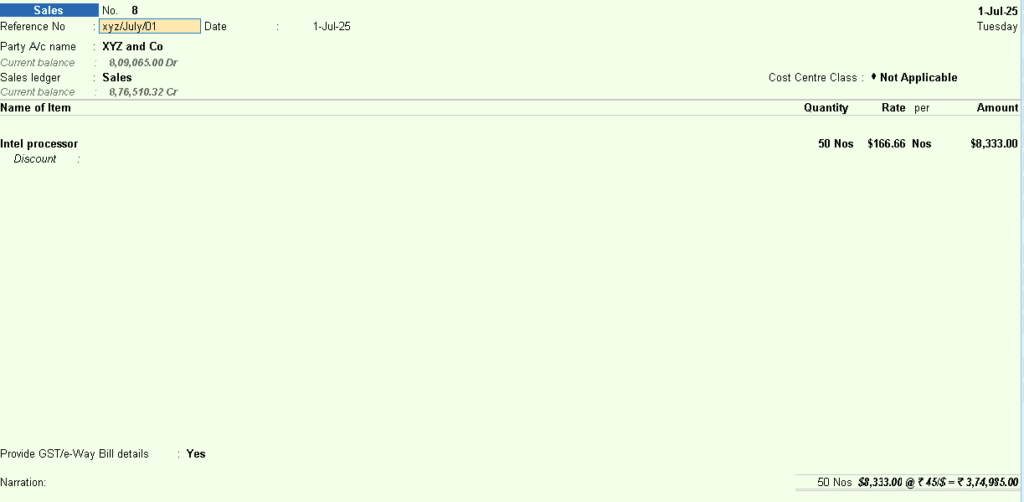

Do the following entry of sales voucher.

On 1/7/2025 Company Sales 40 Intel processor each at Rs. 7,500 to XYZ and Co. Now make a Sales invoice with bill no. xyz/July/01, When dollar rate was Rs. 45/$.

Sales Voucher: – (F8)

Party’s Name: -XYZ and Co.

Sales Ledger: -Sale a/c

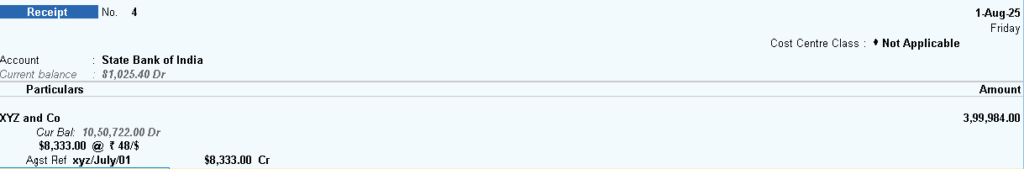

Receipt Voucher: –

On 1/8/2025, Company received Full amount against bill no. xyz/July/01, when rate of exchange was 48/$.

Gateway of tally —–> Vouchers ——-> Receipt (F6)

Now during Sale rate of exchange was Rs. 45/- and During Receipt the rate of exchange was Rs. 48/- Means you have to more amount than the amount which was entered during the sale entry, so it means that we have got profit.

Note: –

When rate per dollar is increased (Profit)

When rate per dollar is decreased (Loss)

To See the Profit, go to,

Gate of tally ——> Display —–> Account book ——> ledgers —–> XYZ & Co.

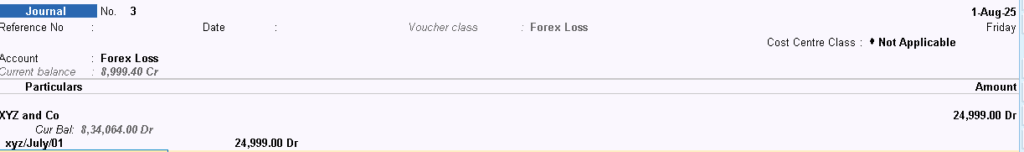

Journal Voucher (Forex Loss): –

Now we have to pass a Journal Adjustment Entry in journal Voucher

Gateway of tally —–> Accounting Voucher —–> Press F7

Name: – Forex Profit

Class: – Profit

Particular: – party name (XYZ and co.) Amount will come automatically.

To view the entry you have passed, go to

Gate of tally ——> Display —–> Account book ——> ledgers —–> XYZ & Co.

Multi-Currency Assignments: – (Sales)

| Ques 01) | |

| 1-5-2023 | Company Sales 5 Samsung galaxy m30s each at 13500/ rupees to Swaroop & Co. where rate of exchange was rupees 56/$ with invoice no. Swaroop/may/001. |

| 1-6-2023 | Company received from Swaroop & Co.by HDFC bank against bill no. Swaroop/may/001, while paying rate of exchange was rupees 57/$. |

| Show the Report of ledger for profit loss and pass the Journal entry to adjust the remaining amount. | |

| Ques 02) | |

| 1-7-2023 | Company Sales 10 MI Note 5 Pro each at 11500/ rupees to Bajaj & Co. where rate of exchange was rupees 61/$ with invoice no. Bajaj/June/001. |

| 1-8-2023 | Company received from Bajaj & Co. & groups by ICICI bank against bill no. Bajaj/June/001, while paying rate of exchange was rupees 60/$ |

| Show the Report of ledger for profit loss and pass the Journal entry to adjust the remaining amount. | |

| Ques 03) | |

| 1-8-2023 | Company Sales 15 Laptops each at 62000/ rupees to Ruby & Co. where rate of exchange was rupees 60/$ with bill no. Ruby/002. |

| 1-9-2023 | Company received from Ruby & Co. by HDFC bank against bill no. Ruby/002, while paying rate of exchange was rupees 62/$. |

| Show the Report of ledger for profit loss and pass the Journal entry to adjust the remaining amount. | |

| Ques 04) | |

| 1-9-2023 | Company Sales 08 Led T.V. each at 40000/ rupees to Mayur & Co. where rate of exchange was rupees 68/$ with bill no. Mayur/sep/001. |

| 1-10-2023 | Company received from Mayur & Co. by State bank against bill no. Mayur/sep/001, while paying rate of exchange was rupees 67/$. |

| Show the Report of ledger for profit loss and pass the Journal entry to adjust the remaining amount. | |