Import of Goods in Tally Prime

An Import Entry in Tally Prime is used to record the import of goods from foreign suppliers. It helps in maintaining proper accounting for customs duty, IGST (Integrated Goods and Services Tax), shipping charges, and other expenses related to imports.

Do the following entry according to give step to understand the import of goods in tally prime.

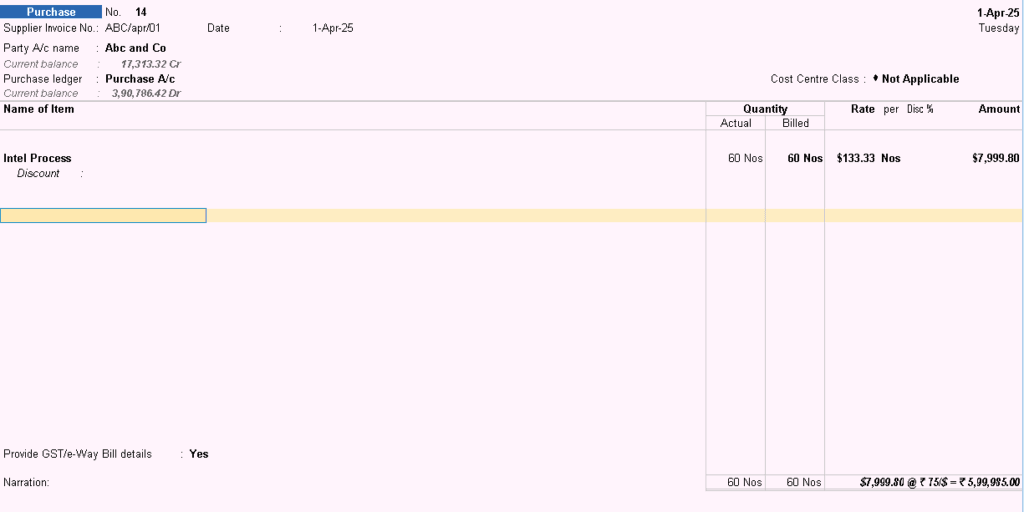

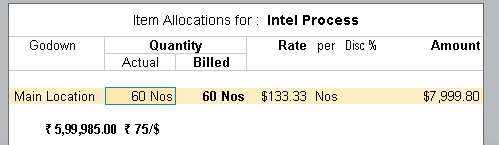

On 1/4/2025, Company purchases 60 Intel processor each Rs. 8, 500/- Where rate of exchange was 75/$ from ABC and Co. make a purchase invoice with bill no. ABC/apr/01.

Gateway of tally —–> Vouchers ——> Purchase (F9)

Party’s Name: -ABC and Co. (Sundry Creditors)

Purchase Ledger: -Purchase A/c (Purchase Account)

Changing INR to Dollar

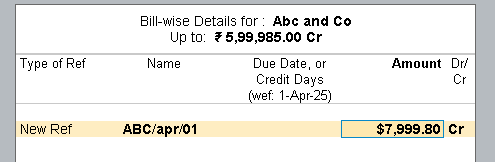

To do bill wise entry selecting new reference

Payment Voucher (F5): –

On 1-5-2025, company make check payment (state Bank of India) of bill no. ABC/apr/01 to ABC and Co. Where dollar rate was Rs. 77/$.

Note: –

- When rate per dollar is increased (Loss)

- When rate per dollar is decreased (Profit)

During Purchase rate of exchange was Rs. 75/- and During payment the rate of exchange was Rs. 77/-. Means you have to more amount than the amount which was entered during the purchase entry, so it means that we have suffer a loss.

To See the Loss, Go To,

Gateway of tally ——> Display —–> Account book ——> ledger —–> ABC & Co.

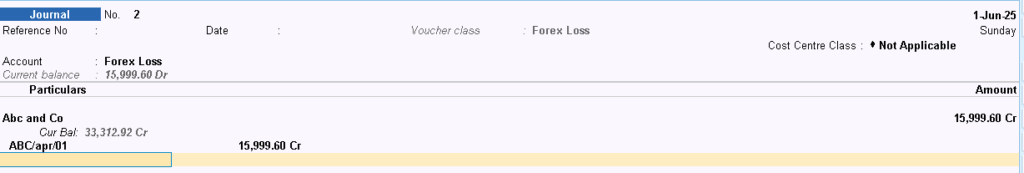

Journal Voucher Class creation

On 1-6-2025, Now we have to pass a journal adjustment entry in journal voucher where date will be not before payment voucher.

Gateway of tally —–> Vouchers —–> Journal Voucher (F7)

Name: – Forex Loss

Class: – Loss

Particular: – party name (ABC and co.) Amount will come automatically.

To view the entry you have passed, go to

Gateway of tally ——> Display —–> Account book ——> ledger—–> ABC & Co.

After journal entry unjust amount of foreign exchange loss/profit will be adjusted in Journal voucher.

Multi-Currency Assignments: – (Purchase)

| Ques 01) | |

| 1-5-2023 | Company purchase 10 Samsung galaxy m30s each at 12500/ rupees from Wadiya and co groups. where rate of exchange was rupees 56/$ and bill no is Wadiya/001. |

| 1-6-2023 | Company Paid to Wadiya group by HDFC bank against bill no. Wadiya/001 while paying rate of exchange was rupees 57/$. |

| Show the Report of ledger for profit loss and pass the Journal entry to adjust the remaining amount. | |

| Ques 02) | |

| 1-7-2023 | Company purchase 15 MI Note 5 Pro each at 10500/ rupees from Anupam Co. & groups. where rate of exchange was rupees 61/$ with invoice no Anupam /123. |

| 1-8-2023 | Company Paid to Anupam Co & groups by ICICI bank against bill no. Anupam /123. while paying rate of exchange was rupees 60/$. |

| Show the Report of ledger for profit loss and pass the Journal entry to adjust the remaining amount. | |

| Ques 03) | |

| 1-8-2023 | Company purchase 20 Laptops each at 60000/ rupees from Tata & Co. where rate of exchange was rupees 60/$ with invoice no Tata/008. |

| 1-9-2023 | Company Paid to Tata & Co. by HDFC bank against bill no Tata/008, while paying rate of exchange was rupees 62/$. |

| Show the Report of ledger for profit loss and pass the Journal entry to adjust the remaining amount. | |

| Ques 04) | |

| 1-9-2023 | Company purchase 12 Led T.V. each at 35000/ rupees from Birla & Co. where rate of exchange was rupees 68/$ with invoice no Birla/009. |

| 1-10-2023 | Company Paid to Birla & Co. by State bank against bill no. Birla/009, while paying rate of exchange was rupees 67/$ |

| Show the Report of ledger for profit loss and pass the Journal entry to adjust the remaining amount. | |